Bitcoin price dips 17,5%

The Bitcoin (BTC) price experienced a dip of 17.5% from its all-time highs, with recent losses bottoming at $60,760. This downturn coincides with notable outflows from U.S. spot Bitcoin ETFs and anticipation around the Federal Reserve’s interest rate decision. Market observers are closely watching for any changes in rates or guidance from the Fed, with current expectations suggesting a low likelihood of a pivot to rate cuts in the near term.

Spot Bitcoin ETFs experienced their second consecutive day of net outflows, highlighting a period of financial turbulence for these investment products. Despite a smaller withdrawal from the Grayscale Bitcoin Trust compared to a record outflow previously, the overall sentiment remains cautious with nearly $500 million exiting spot BTC ETFs in just two trading sessions. Analysts suggest a potentially choppy market ahead before any rebound.

Source: Cointelegraph

Analysts Cast Doubt on Ether ETF Approvals for May by the SEC

Bloomberg analysts suggest the SEC is unlikely to approve spot ether ETFs this May, noting a decrease in dialogue compared to the bitcoin ETF approval process. With seven issuers, including BlackRock and Fidelity, hoping to launch ether funds, the lack of communication hints at possible rejections. This situation contrasts with previous interactions over bitcoin ETFs and highlights the regulatory uncertainties facing cryptocurrency investments. The decision due by May 23 will significantly impact the market’s accessibility to ether ETFs.

Source: Coinpaprika

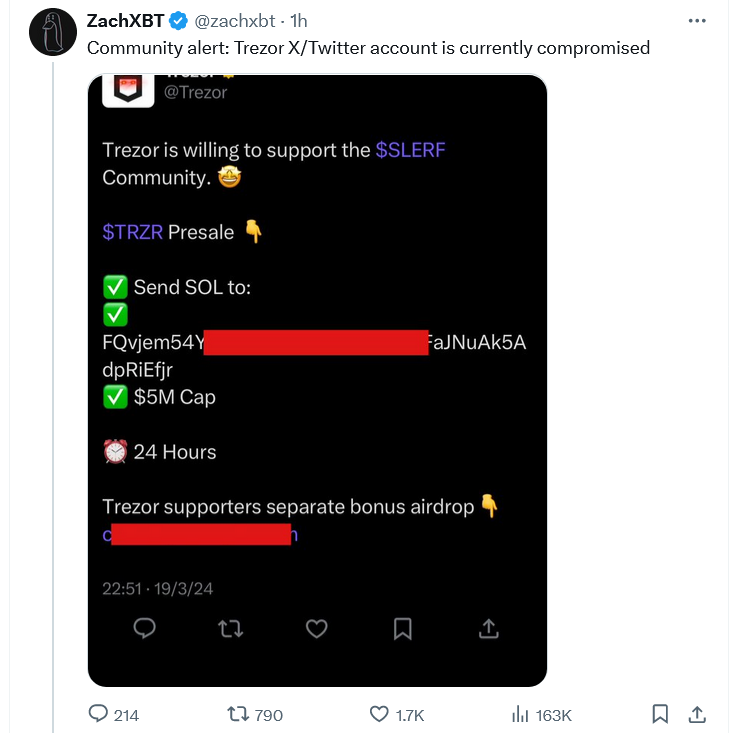

Trezor X Hit by Phishing Attack Promoting Bogus Tokens

The Trezor X account was compromised, resulting in posts that solicited users to participate in a fraudulent presale for a non-existent token, leading to suspicions of a SIM-swap attack. The hackers advertised a fake “$TRZR” token and directed followers to malicious sites designed to drain wallets, managing to steal a modest sum from Trezor’s Zapper account. Despite the breach, the illicit posts were quickly removed from the platform.

Source: Cointelegraph