Trump signs executive order for bitcoin strategic reserve

In a historic move, US President Donald Trump has signed an executive order to create a Bitcoin Strategic Reserve. This decision solidifies Bitcoin’s role in the U.S. economy and signals the government’s long-term commitment to digital assets. The move is aimed at enhancing financial sovereignty and reducing reliance on traditional fiat currencies.

Following the announcement, the White House released a statement referring to Bitcoin as “digital gold”, highlighting its strategic importance. The administration emphasized that securing a national Bitcoin reserve would ensure America’s leadership in financial innovation.

By likening Bitcoin to gold, the U.S. government acknowledges its store-of-value properties, especially in times of economic uncertainty. Experts predict this decision could have far-reaching effects on Bitcoin’s price and global adoption, as other nations may follow suit.

According to White House Crypto Czar David Sacks, the Bitcoin reserve will be funded entirely through forfeited Bitcoin from criminal and civil asset seizures, meaning there will be no cost to taxpayers. Current estimates suggest the U.S. government holds around 200,000 BTC, but a full audit has been ordered to confirm the exact holdings.

The reserve will act as a “digital Fort Knox,” ensuring that Bitcoin is stored strategically rather than prematurely liquidated. Sacks pointed out that previous government Bitcoin sales resulted in $17 billion in lost value.

Additionally, the order establishes a U.S. Digital Asset Stockpile to manage other seized cryptocurrencies under the U.S. Treasury. With this initiative, Trump strengthens the U.S.’s position as the potential “crypto capital of the world.”

Source: Altcoinbuzz

Trump’s White House Crypto Summit and Bitcoin reserve debate

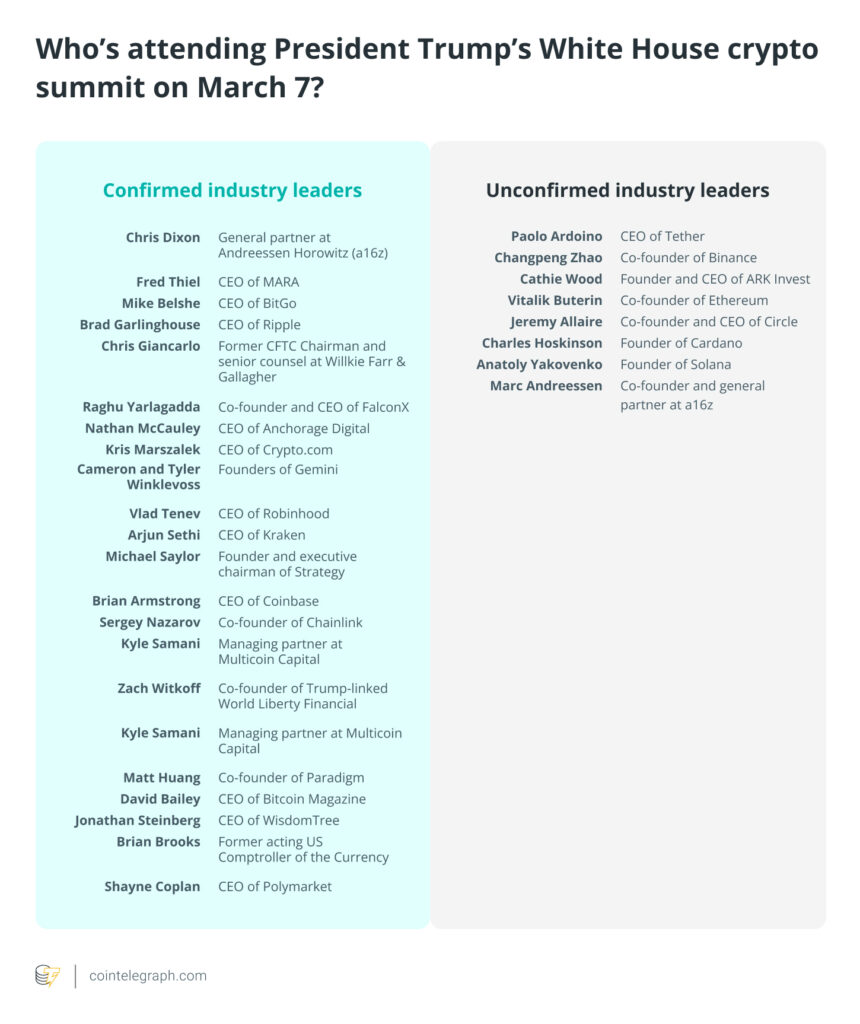

On March 7, US President Donald Trump will host the first-ever White House Crypto Summit, bringing together over 20 industry leaders and government officials. This event follows Trump’s recent executive order establishing a Strategic Bitcoin Reserve and a Digital Asset Stockpile.

The summit will take place from 6:30 pm to 10:30 pm UTC and is expected to include at least 25 participants, including members of the Presidential Working Group on Digital Assets. Fox Business reporter Eleanor Terrett confirmed that 22 crypto executives and two White House representatives will attend. Notably, Tether CEO Paolo Ardoino and Binance co-founder Changpeng Zhao have not yet confirmed their participation.

While the full list is still unconfirmed, key figures from the SEC, CFTC, Treasury, and Commerce Departments are expected to join. Meanwhile, Ardoino was spotted in Washington, D.C., attending a CFTC-hosted crypto CEO forumalongside industry leaders from Ripple, MoonPay, Crypto.com, Circle, and Coinbase.

A separate reception is being planned near the White House for those not invited to the official summit. The crypto community is also pushing for the inclusion of notable figures like Cathie Wood (ARK Invest), Vitalik Buterin (Ethereum), Jeremy Allaire (Circle), Charles Hoskinson (Cardano), and Anatoly Yakovenko (Solana).

The summit coincides with ongoing controversy over Trump’s Bitcoin reserve executive order, signed on March 6. While many view it as a historic moment for crypto, some are disappointed that the US only plans to hold confiscated Bitcoin (~200,000 BTC) instead of actively buying more.

10x Research noted that the market had expected large BTC purchases, while Coinbase’s Conor Grogan argued that Trump’s policy at least removes $18 billion in selling pressure from the market. Further announcements may clarify the administration’s long-term crypto strategy.

Source: Cointelegraph

Texas becomes first U.S. state to establish a strategic bitcoin reserve

In a historic first, Texas has officially passed Bitcoin Reserve Bill SB21, allowing the state to hold Bitcoin as part of its financial reserves. Approved on March 6, 2025, this move positions Texas as a leader in state-level Bitcoin adoption, marking a major step in integrating digital assets into public treasury management.

The newly passed law authorizes the Texas State Treasury to purchase, hold, and manage Bitcoin as part of its investment strategy. The bill also establishes a legal framework for secure custody solutions, ensuring that state-owned Bitcoin is stored in a transparent and compliant manner.

According to Senator Bryan Hughes, a key supporter of SB21:

“Bitcoin is digital gold, and by integrating it into our state reserves, we are embracing financial innovation while protecting against the devaluation of the U.S. dollar.”

Texas has already positioned itself as a Bitcoin mining hub, thanks to favorable regulations and abundant energy resources. The passage of SB21 is expected to attract further investment into Texas’ blockchain and crypto sector, reinforcing its pro-crypto stance.

With this move, Texas joins Wyoming and El Salvador in recognizing Bitcoin as a reserve asset, adding momentum to the debate on state and federal digital asset policies. Critics, however, warn of Bitcoin’s volatility, stressing the importance of responsible fund management.

Now that SB21 is law, Texas will develop infrastructure to purchase and store Bitcoin securely. Experts predict that other pro-Bitcoin states may follow Texas’ lead, accelerating the trend of U.S. states integrating digital assets into their financial reserves.

This landmark decision cements Texas’ role as a trailblazer in the Bitcoin revolution and could influence broader nationwide adoption in the future.

Source: Coinpaprika